Amortization Calculator – What it is, its types, and benefits

Amortization is an accounting term that details the change in the value of financial instruments or intangible assets over time. Simply put, it is the process of paying off debt over time in equal installments. As an individual makes payments, one part goes toward reducing the loan principal and the other toward paying the interest. Based on the amortization process, an amortization calculator is used to calculate the periodic payment amount owed on a loan.

What is an amortization calculator?

As mentioned, when paying off a loan, a part of the monthly payments goes toward the principal, while the other portion goes toward the interest. An amortization calculator is used to determine how much of the payment goes where. This calculator allows an individual to track the remaining principal and interest on the loan, which helps one understand how the loan’s value changes over time. It also helps gain insight into the long-term cost of the fixed-rate mortgage and details of the principal one needs to pay over the entire lifespan of the loan. It is also helpful in understanding how one’s mortgage payments are structured.

However, it is important to know that amortization does not only apply to mortgages. Auto and personal loans are also standard amortizing loans.

How to calculate amortization?

While using an amortization calculator, one must follow these steps:

Enter the loan amount: The first requirement is the amount one plans to get or has borrowed for the mortgage. One must enter this amount in the loan amount field.

Enter the loan term: In the loan term field, one must mention how many years one has to repay the loan. This term might be fifteen years, thirty years, or any other duration.

Enter the interest rate: Here, one must mention the interest rate one is paying on the mortgage.

Enter the loan start date: One must mention the month when the first payment was made.

Adding these inputs to the amortization calculator helps analyze or calculate one’s monthly payments. If one wants to dive deep into the additional details, like gaining information about the interest to be paid, one must refer to the amortization schedule.

Types of amortization calculator

Here are various types of amortization calculators:

Simple amortization calculator: The simple amortization calculator helps calculate the principal one must pay for the entire loan lifetime.

Mortgage amortization calculator: The mortgage amortization calculator is a valuable tool for determining the breakdown of the payment schedule month by month. It also gives one an idea of how much one saves on interest and how much the repayment time is shortened when one makes extra payments. This calculator probably cannot be used for an adjustable-rate mortgage.

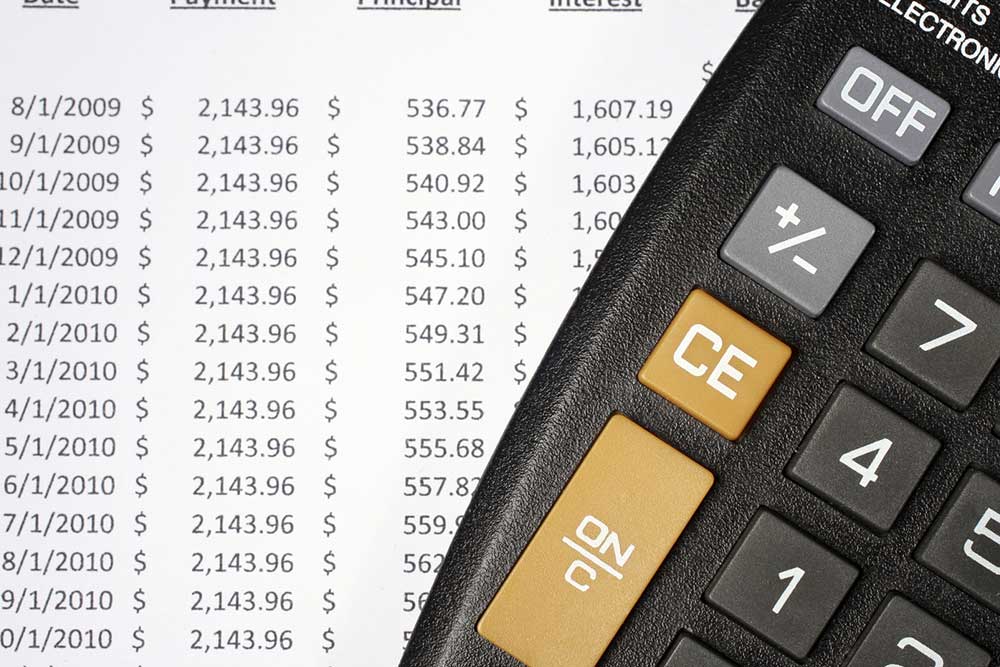

Amortization schedule calculator: The amortization schedule calculator provides a breakdown of the monthly payments. It helps individuals determine the amount of money that goes toward the principal and interest for each payment. Using the calculator, one can easily track the principal balance at any given point and determine the total interest paid during the entire period. The results are presented in a clear and easy-to-read table format.

Benefits of using an amortization calculator

Using an amortization calculator has many benefits. While one may also use spreadsheets or standard calculators to perform amortization calculations, this calculator provides faster and more structured outcomes. Here are some of its benefits:

Saves effort and time: The amortization calculator helps save time and effort in estimating the monthly payment amount and schedule. It provides accurate results when the inputs are correct.

Knowledge and awareness: It helps one understand how loans work and how much monthly payment needs to be paid. The schedule provides detailed insights into the principal amount one owes at present or in the future. Additionally, one can calculate the extra amount required to pay off the mortgage entirely by paying more every month.

Helps choose the best loan option: The amortization calculator allows one to make an informed decision when choosing a loan by comparing various types of loans. If one has yet to choose the type of loan, the schedule and calculator can help one understand how terms, interest rates, and multiple types of loans influence the amounts that one pays monthly. This allows one to select the best option.

Tips to pay off the mortgage faster

The following tips and strategies are valuable in paying off the mortgage faster and quicker:

- Making extra or biweekly payments instead of monthly payments can help repay the loan quickly and save money on interest.

- Recasting and refinancing are other valuable options for paying off loans faster.

An amortization calculator has several benefits. It works for any loan, whether a fixed-rate mortgage, student loan, or auto loan. However, it is important to note that if one plans to pay off one’s mortgage before schedule, the lenders sometimes charge the prepayment penalties. Thus, one must thoroughly discuss the terms and conditions with the lender to avoid such issues. Also, checking the reviews, ratings, testimonials, and recommendations while choosing a mortgage loan partner is suggested to avoid any unpleasant experience and have peace of mind.