The advantages and disadvantages of opening a savings account

A savings account is an interest earning account at any financial institution or a bank. The bank imposes a limit on the number of withdrawals that can be made from this account per month. Most often, banks do not provide check books with this kind of an account, as the ulterior aim is to save and not to spend.

Advantages

- Safekeeping of money: When people save money, they tend to carry it around or keep it in a certain place.

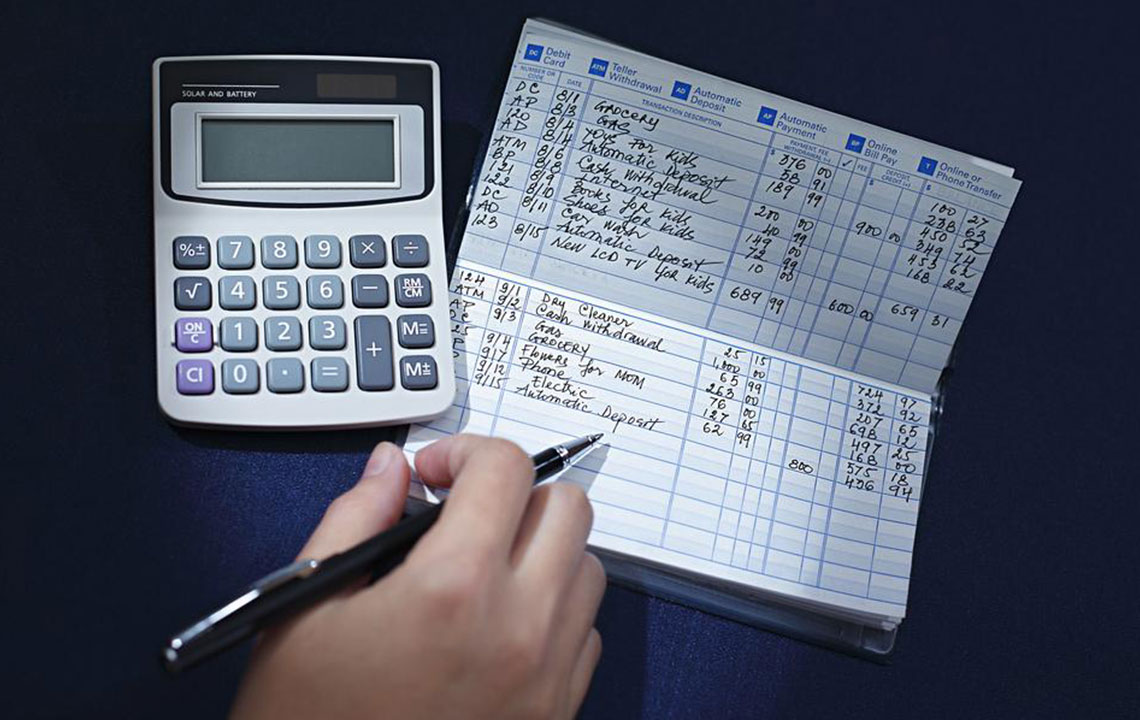

This is not the safest way to store money. A bank or a financial institution provides a person with an account for storing money and this way the money remains safe. The initial investment is small: Most banks allow one to open a savings account with the minimal amount of money. A person can open a savings account with as little as a spare $10. Connection with checking account: Most savings accounts can be linked to the checking account of the account holder. This way, the account holder can easily transfer money from their savings account to their checking account, if their checking account balance is running low. Automated bill payments: One can use their credit or debit card for automated payments every month. Although, if somebody does not possess either of the two cards, they may use their savings account to pay the automated bills.

Disadvantages

- Insurance is available, but only up to a certain amount: The Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Share Insurance Fund (NCUSIF) provides insurance to the account holders of savings accounts. However, each of these insurance claims is limited to a certain amount, which means that you will not get full coverage if your balance is higher than the limit.

- Temptations: The quick and easy access to these savings accounts usually tempt the account holder to spend the money available. This makes it difficult to achieve any long-term savings plans.

- Minimum balance: Most savings accounts require a minimum balance in the account and also charge fines if the amount in your account is lesser than the specified minimum balance.

Disclaimer:

The information available on this website is a compilation of research, available data, expert advice, and statistics. However, the information in the articles may vary depending on what specific individuals or financial institutions will have to offer. The information on the website may not remain relevant due to changing financial scenarios; and so, we would like to inform readers that we are not accountable for varying opinions or inaccuracies. The ideas and suggestions covered on the website are solely those of the website teams, and it is recommended that advice from a financial professional be considered before making any decisions.